Table of content

Government Grants

Key Characteristics of Government Grants

Purpose-driven: Allocated for specific projects or objectives.

Eligibility criteria: Applicants must meet certain conditions, which may include business size, sector, or location.

Application process: Often competitive, requiring detailed proposals and documentation.

Top Government Grant Programmes for Startups in the UK

The UK government offers several flagship programmes specifically designed to support startup growth and innovation. These initiatives have been particularly successful in helping early-stage businesses access the funding they need to develop their ideas and bring them to market. For startups looking to understand different funding stages, our guide on seed funding provides comprehensive insights into early-stage financing options.

For startups considering various funding approaches, our analysis of angel investors vs venture capitalists can help determine the best financing strategy for your business stage. Additionally, exploring crowdfunding options might provide alternative funding routes.

Innovation and R&D Grants

| Grant Name | Region | Purpose | Funding Amount | Link |

|---|---|---|---|---|

| Innovate UK Smart Grants | UK | Support commercially viable R&D | Varies | Apply Now |

| Knowledge Transfer Partnership (KTP) | UK | University-business collaboration | Varies | Explore |

| Horizon Europe | EU | Collaborative R&D across borders | €95.5 billion (overall budget) | Apply |

| EIC Accelerator | EU | High-impact innovations by SMEs | Up to €2.5 million | More Info |

Regional and Development Grants

| Grant Name | Region | Focus | Funding Amount | Link |

|---|---|---|---|---|

| Northern Powerhouse Investment Fund | UK | Economic development in North England | Varies | Apply Now |

| Midlands Engine Investment Fund | UK | SME growth in the Midlands | Varies | Explore |

| European Regional Development Fund (ERDF) | EU | Reduce economic disparities between regions | Varies | Apply |

Small Business Funding Options from the Government in 2025

Sustainability and Green Initiatives

Types of Government Grants for Small Businesses

Government funding typically comes in various forms, so it’s important to know which type best fits your needs:

- Direct Grants: Lump sums provided for specific projects, often with strict reporting requirements.

- Matched Funding: You’ll need to match a portion of the grant with your funds or other investments.

- Tax Incentives & Credits: Reduce your taxable income or get rebates for eligible activities, like R&D or sustainability improvements.

- Loans & Guarantees: Low-interest government-backed loans or guarantees to help you secure commercial financing.

- Innovation Vouchers: Small amounts to fund specialist advice, research, or collaboration with universities.

When applying, check eligibility criteria carefully and ensure your business plan aligns with the funding priorities (e.g., green tech, digital innovation, job creation).

Eligibility Criteria for Government Business Grants

Understanding eligibility requirements is crucial for successful grant applications. Most government grants have specific criteria that businesses must meet to qualify for funding. Here are the key eligibility factors to consider:

General Eligibility Requirements

- Business size: Most grants target SMEs (typically under 250 employees)

- Annual turnover: Usually under €50 million for EU grants, varies for UK grants

- Sector focus: Some grants are sector-specific (technology, manufacturing, services)

- Geographic location: Regional grants may require business operations in specific areas

- Innovation level: R&D grants often require demonstration of innovation or technological advancement

Specific Criteria by Grant Type

- Startup grants: May require the business to be less than 3 years old

- R&D grants: Require demonstration of research and development activities

- Export grants: May require evidence of international trade activities

- Sustainability grants: Require environmental impact or green technology focus

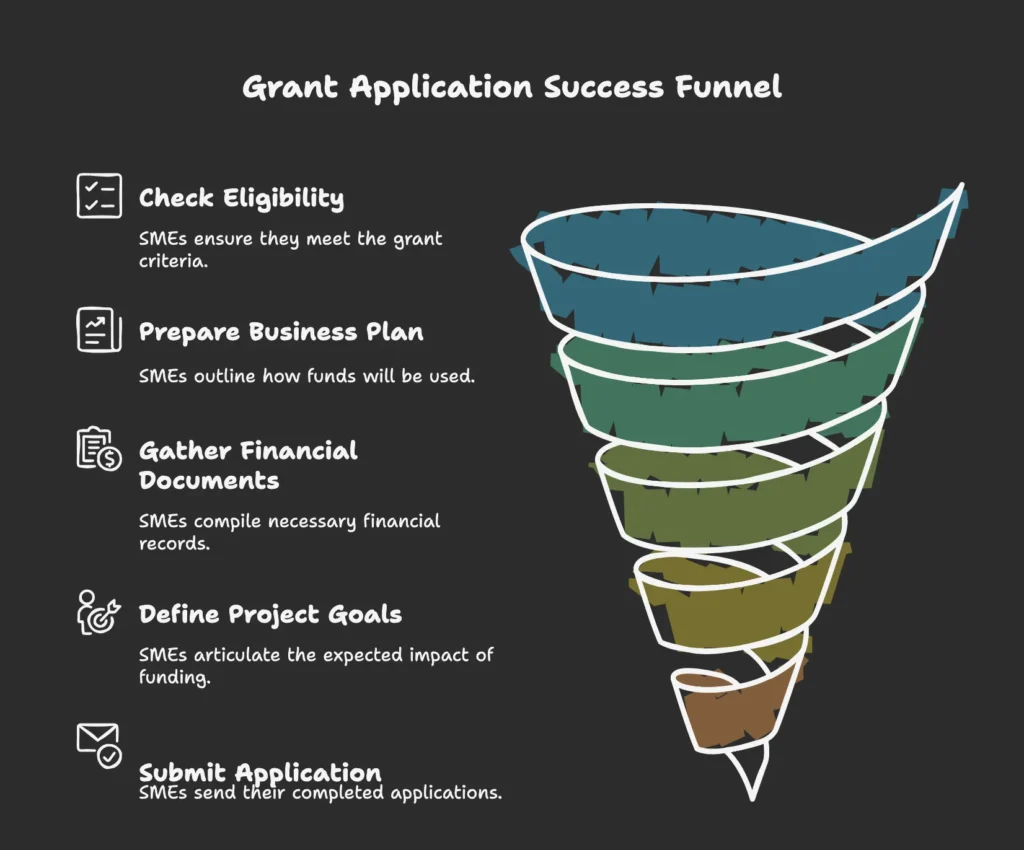

How to Apply for Government Grants for Small Businesses in the UK 2025

The application process for government grants in 2025 has been streamlined with improved digital platforms and clearer guidance. Success depends on thorough preparation and understanding of the specific requirements for each grant program. Our comprehensive guide on how to pitch ideas to investors provides valuable insights that can enhance your grant application presentations.

Key Application Platforms

- Find a Grant (UK) – The primary portal for UK government grants

- EU Funding & Tenders Portal – For European Union funding opportunities

- Innovate UK – Specifically for innovation and R&D funding

- Enterprise Europe Network – Provides guidance and support for applications

Want to explore more ways to fund your small business? Check out our comprehensive guide to SME funding options.

Step-by-Step Process for Applying Government Grants

Step 1: Research and Identify Suitable Grants

- Use government grant databases and search tools

- Filter by business size, sector, and location

- Review grant objectives and ensure alignment with your business goals

- Check application deadlines and funding cycles

- Subscribe to grant alerts for future opportunities

Step 2: Assess Your Eligibility

- Review detailed eligibility criteria for each grant

- Ensure your business meets size and sector requirements

- Check geographic restrictions and operational requirements

- Verify that your project aligns with the grant objectives

- Confirm you have the necessary legal structure and registrations

Step 3: Prepare Your Application Documentation

- Business plan: Detailed overview of your business and growth strategy

- Financial statements: Recent accounts, cash flow projections, and financial forecasts

- Project proposal: Clear description of how you’ll use the grant funding

- Market research: Evidence of market need and commercial viability

- Team credentials: Qualifications and experience of key personnel

- Supporting documents: Relevant certificates, permits, and legal documentation

Step 4: Develop Your Project Proposal

- Define clear project objectives and deliverables

- Create a detailed timeline with milestones

- Establish measurable outcomes and success metrics

- Identify potential risks and mitigation strategies

- Demonstrate economic impact and job creation potential

Step 5: Complete the Application Form

- Follow platform-specific guidelines and formatting requirements

- Ensure all sections are completed accurately and thoroughly

- Use clear, concise language and avoid technical jargon

- Include all required supporting documents

- Review and proofread before submission

Step 6: Submit and Track Your Application

- Submit before the deadline (consider submitting early)

- Retain copies of all submitted documents

- Note your application reference number

- Monitor the application portal for updates

- Respond promptly to any requests for additional information

Step 7: Follow Up and Maintain Communication

- Acknowledge receipt confirmations

- Prepare for potential interviews or presentations

- Be ready to provide additional documentation if requested

- Maintain regular contact with grant administrators

- Plan for potential site visits or due diligence processes

Step 8: Post-Application Management

- If successful, carefully review the grant terms and conditions

- Establish proper project management and reporting systems

- If unsuccessful, seek feedback and consider reapplying

- Use the experience to improve future applications

- Network with other grant recipients for insights and support

Government Grant Application Process Flowchart

Tips for a Successful Grant Application

- Tailor applications to grant goals and demonstrate clear alignment

- Use data and evidence to support impact claims and projections

- Follow formatting guidelines and word limits precisely

- Plan for deadlines and allow time for follow-up documentation

- Seek professional advice or mentorship from experienced grant applicants

- Build relationships with grant administrators and attend information sessions

- Consider partnering with other businesses or research institutions for collaborative applications

For startups looking to strengthen their overall strategy and investor readiness, consider exploring RSVR’s business support services, which can help align your technical capabilities with strategic objectives.

Final Thoughts

Government grants offer SMEs a powerful pathway to scale innovation, reduce financial risk, and create meaningful economic impact. By understanding the landscape and aligning your business goals with available opportunities, you significantly improve your chances of securing funding. The key to success lies in thorough preparation, clear communication of your business value, and persistent follow-up throughout the application process.

For businesses looking to leverage technology for growth, our insights on AI and ML applications for startups can help identify innovative approaches that align with grant objectives. Additionally, addressing and managing technical debt is essential for sustaining long-term growth after securing funding.

Ready to scale? Learn how RSVR helps founders align tech and strategy in our comprehensive business support services.

Frequently Asked Questions (FAQs)

Are government grants taxable?

Yes. Grants are usually treated as taxable income. Consult a tax advisor.

Can I apply for multiple grants?

Yes, as long as they don’t fund the same expense.

How long do applications take?

Processing times vary from weeks to several months.

Are there grants for new startups?

Yes. Many national and EU programmes focus on early-stage innovation.

What's the success rate for government grant applications?

Success rates vary by grant type, typically ranging from 10–30% for competitive programmes.

Can I get help with my grant application?

Yes. Consider using professional grant writers, business advisors, or government support services.

What happens if my application is rejected?

Most programmes provide feedback. Use this to improve and reapply in future rounds.

Where can I learn more about SME funding strategies?

Visit our guide to SME funding options