Table Of Contents

Navigating the landscape of government grants can be a game-changer for small and medium-sized enterprises (SMEs) aiming to innovate, expand, or stabilise operations. Whether you're based in the UK or elsewhere in Europe, understanding the available funding options and how to access them is crucial.

Understanding Government Grants

Government grants are non-repayable funds provided to businesses to support specific activities, such as research and development (R&D), sustainability initiatives, or regional development. Unlike loans, these grants do not require repayment, making them an attractive option for SMEs looking to minimise financial risk.

Key Characteristics of Government Grants:

Purpose-driven : Allocated for specific projects or objectives.

Eligibility criteria : Applicants must meet certain conditions, which may include business size, sector, or location.

Application process : Often competitive, requiring detailed proposals and documentation.

Types of Government Grants Available

Innovation and R&D Grants

| Grant Name | Region | Purpose | Funding Amount | Link |

|---|---|---|---|---|

| Innovate UK Smart Grants | UK | Support commercially viable R&D | Varies | Apply Now |

| Knowledge Transfer Partnership (KTP) | UK | University-business collaboration | Varies | Explore |

| Horizon Europe | EU | Collaborative R&D across borders | €95.5 billion (overall budget) | Apply |

| EIC Accelerator | EU | High-impact innovations by SMEs | Up to €2.5 million | More Info |

Regional and Development Grants

Sustainability and Green Initiatives

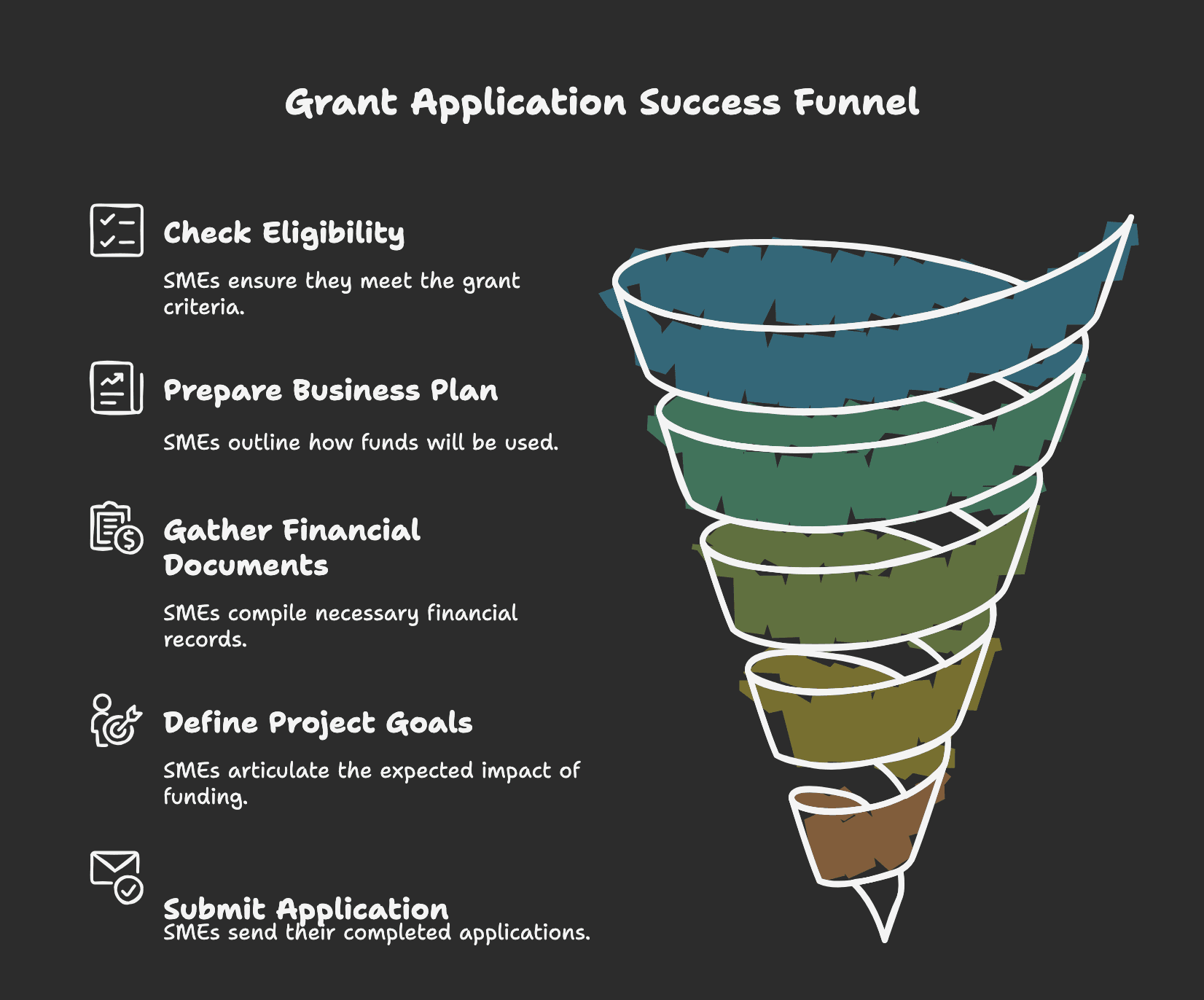

How to Apply for Government Grants

- Identify Suitable Grants : Use tools like Find a Grant (UK) or the EU Funding & Tenders Portal.

- Assess Eligibility : Review eligibility criteria thoroughly.

- Prepare Documentation : Include business plans, financials, and project scope.

- Submit Application : Follow the platform-specific guidelines.

- Seek Advice : Platforms like the Enterprise Europe Network can offer application guidance.

Government Grant Application Process Flowchart

Tips for a Successful Grant Application

- Tailor applications to grant goals.

- Use data to support impact claims.

- Follow formatting guidelines.

- Plan ahead for deadlines and follow-up documentation.

Looking for tailored support? Explore how RSVR helps ventures move from MVP to investment-ready

Final Thoughts

Government grants offer SMEs a powerful pathway to scale innovation, reduce financial risk, and create impact. By understanding the landscape and aligning your business goals with available opportunities, you improve your chances of success.

Ready to scale? Learn how RSVR helps founders align tech, and strategy in our businesses support services.